Rauner budget benefits the wealthy few

As a candidate, Bruce Rauner campaigned hard against extending 2014 income tax rates, ignoring warnings that doing so would force crippling cuts to state government and other public services.

Gov. Rauner got his way. As of Jan. 1, the individual income tax rolled back from 5 to 3.75 percent and the corporate income tax from 7 to 5.25 percent. And now, a new study shows who benefits—and the governor’s budget plan shows who will pay.

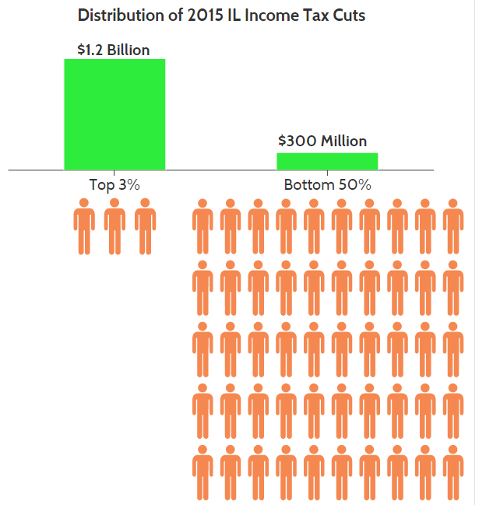

The expiring rates will drain $5 billion a year from the state budget—with 50 percent of the resulting tax breaks going to corporations ($1.3 billion) and the top 3 percent of state tax filers ($1.2 billion), according to the Center for Tax and Budget Accountability.

Under this plan, millionaires are getting an average tax break of $37,000 a year, with Gov. Rauner himself pocketing an extra $750,000 annually, a new Huffington Post column notes.

In contrast, the bottom half of all earners will receive just 8 percent of the benefit ($300 million). Put another way, the governor’s personal $750,000 tax break is more than 1,400 times greater than that of the typical working family ($526).

In contrast, the bottom half of all earners will receive just 8 percent of the benefit ($300 million). Put another way, the governor’s personal $750,000 tax break is more than 1,400 times greater than that of the typical working family ($526).

Doling out tax breaks so blatantly skewed to the wealthy will only make income inequality even worse—and it’s already a big problem in Illinois. During the economic recovery years of 2009 through 2012, 97 percent of all income gains in our state went to the top 1 percent, the nonpartisan Economic Policy Institute has shown.

Even worse, the governor laid out a scorched-earth budget for the coming year that would keep the tax breaks in place while slashing public services. In effect, the Rauner budget plan would fund giveaways to big corporations and the wealthy few by making billions of dollars in cuts to essential public services, harming every Illinois resident but especially those struggling to join or remain part of the middle class.

The contrast caused Greg Hinz, columnist for Crain’s Chicago Business, to wonder, “Where’s the ‘shared sacrifice’ for the rich in Rauner’s budget?” Hinz wrote:

While poor people and middle-class people and workers and transit riders and just about everyone else is being asked to take it in the ear in the name of "shared sacrifice," people of means get off scot-free. In fact, they're actually better off. …

[E]veryone but the rich will suffer from spending cuts, while the rich get big tax cuts.

Consider who uses public transit. Or Medicaid, or a series of other social welfare programs for which spending would be slashed. Consider who works for state government and now is being proposed for lesser retirement and health benefits.

Answer: not people who live up with Rauner on the North Shore. … [T]hey got a big boon from Rauner over the holidays when he put a brick on efforts to extend the state income tax hike. As I reported earlier, that saved the state's millionaires—0.2 percent of state income tax filers—more than everyone in the state collectively who earns up to $35,000 a year.

The effect is unmistakable: Most of us are being asked to make a sacrifice. But a few got a nice tax cut.