Illinois needs fair tax reform

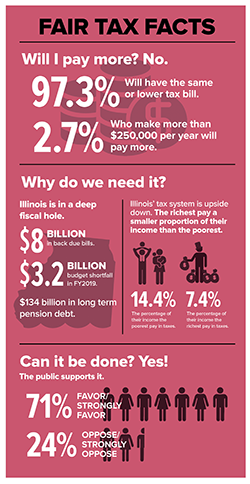

Raising the necessary revenue from those who can afford to pay a little more—while holding the line on taxes for 97 percent of filers—is the fair tax reform that’s long overdue in Illinois.

Raising the necessary revenue from those who can afford to pay a little more—while holding the line on taxes for 97 percent of filers—is the fair tax reform that’s long overdue in Illinois.

Current system unfair, inadequate

The state’s current tax structure is inadequate because it doesn’t raise enough revenue, leaving state government with a $3.2 billion budget shortfall in the current year alone, not to mention more than $8 billion in unpaid bills. The fair tax is also the best way to ensure public employees receive the pension benefits they are owed, as our state faces $134 billion in long term pension debt.

As a result, critical needs like state and local government services, schools and universities, and infrastructure such as roads and bridges are all underfunded.

The current tax structure is also unfair. The revenue our state raises comes disproportionately from working people because the state Constitution mandates that everyone from a billionaire to a health care aide pay the same income tax rate.

When you add in sales and property taxes, working people wind up paying almost twice as much of their income in taxes (14.4%) as the state’s wealthiest people (7.4%).

A fair tax with higher rates for people with higher incomes and lower rates for people with lower incomes is the approach used by more than 30 other states—including four of Illinois’ five neighbors—and the federal government.

Gov. Pritzker’s proposal would raise taxes only on income over $250,000 a year. That means 97% of us would pay the same or less than we’re paying now. In addition, the plan would create a new child tax credit to benefit families and double the property tax credit to help homeowners.

That's why the Illinois Senate voted 40-19 to pass the fair tax constitutional amendment. Now it goes on to the House.

Big-money interests oppose fair tax

The main forces organized against the fair tax are big business and corporate CEOs and the anti-union Illinois Policy Institute funded by Bruce Rauner and the Koch Brothers.

This shouldn’t surprise union members. The same big-money forces have long pushed to cut pensions, lay off workers, wipe out collective bargaining and repeal the state constitution’s pension protection clause.

“Why would any of us ever rely on the Illinois Policy Institute, with its well-documented propensity for distortions and double-talk, to get the real facts about anything?” Council 31 Executive Director Roberta Lynch asked. “The IPI has the same agenda it has always had, consolidating the wealth and power of the already super-rich.”

Tell lawmakers: Support the fair tax

While polling shows most voters support a fair tax, we can’t have a say until a three-fifths supermajority of the state House approve a resolution to put the fair tax constitutional amendment on the ballot.

Our state representatives need to hear from us. Call the fair tax legislative hotline at 888-412-6570 to reach your state represenative now! Tell them to vote YES for the fair tax that our state needs to thrive.