Fair Tier 2: The path forward

Looking for answers to your Tier 2 questions? Click here!

Tier 2 is fundamentally unfair

In 2010, over fierce opposition from AFSCME and other unions, the Illinois General Assembly enacted legislation which created a separate tier of lower pension benefits for virtually every Illinois public employee hired on or after Jan. 1, 2011.

In 2010, over fierce opposition from AFSCME and other unions, the Illinois General Assembly enacted legislation which created a separate tier of lower pension benefits for virtually every Illinois public employee hired on or after Jan. 1, 2011.

This so-called Tier 2 benefit was touted as a way to slow the growth of unfunded liabilities across the pension systems, but in reality, its inequities betrayed the promise of a fair, secure retirement after a career in service to the public.

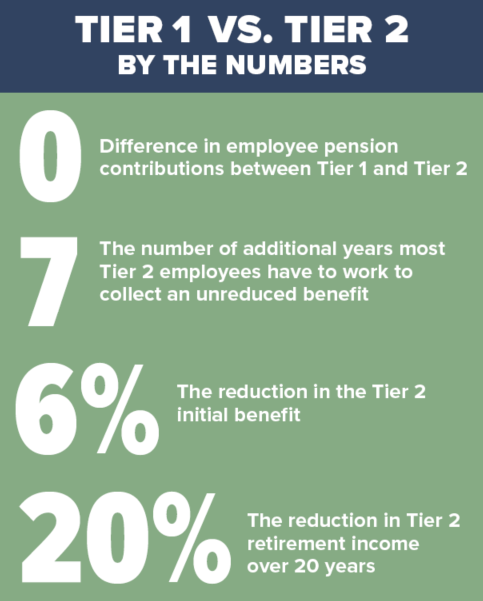

Tier 2 participants make the same level of employee contributions as Tier 1 participants, but their retirement benefit calculation and retirement security are inferior in significant ways.

The changes to benefits for Tier 2 employees include:

- Tier 2 increased the vesting requirement for workers by two years. This means that Tier 2 participants must now work 10 years for an employer before their pension benefits are guaranteed. If an employee leaves prior to 10 years of service, they are only eligible for refund of their individual contributions.

- Tier 2 increased the retirement age to qualify for full benefits by up to seven years, depending on the employer. Most Tier 2 employees must work until age 67 to receive their normal retirement benefit, whereas their Tier 1 peers can retire at age 60. (Retirement ages are lower for those in law enforcement.)

- Tier 2 reduced the final average salary (FAS) calculation from the average of the highest four years of salary to the average of the highest eight years of salary. FAS is important because it is a factor used to determine the initial pension benefit for a retiree. By reducing the FAS calculation for a Tier 2 participant, the pension benefit they are eligible for is cut significantly.

- Tier 2 cut the annual benefit increases in retirement from 3% to the lesser of 3% or one-half of the consumer price index. For those systems where the annual increase was calculated on a compounded basis (i.e., the increase was calculated on the prior year’s benefit level), Tier 2 changed it such that the annual increases are on a simple interest basis. This means that the annual percent increase is always based on the initial pension amount. This change dramatically limits the ability of retirement income to keep up with rising costs throughout a person’s retirement.

Understanding the challenges

The financial health of a retirement system is measured by the extent to which the assets on hand cover the cost of the pension benefits earned by workers. Ideally, an employer’s annual pension contribution should be calculated based on benefit costs and unfunded liabilities. Such practices, however, have not been followed in Illinois, as the state and local governments have skimped on their pension contributions for decades as a strategy to balance their annual budgets. Rather than raising taxes and other revenue to cover the cost of government operations, inadequate pension contributions became the norm.

Those decades of inadequate contributions left almost all Illinois pension funds among the worst funded in the United States. The unfunded liability of the state’s five retirement systems (SERS, SURS, TRS, General Assembly, Judges) was a combined $142.3 billion as of June 30, 2023. These funds were, on average, 44.6% funded, meaning they had the assets on hand to cover less than half of earned pension benefits. The unfunded liability across the four City of Chicago retirement funds (MEABF, Police, Fire, Laborers) stands at $35 billion, with those systems being some of the lowest-funded in the country.

Pension funding laws have been passed that increased employer funding of the retirement systems, with most on track to reach 90% funded by 2045. The state’s FY 2024 pension contribution for the five systems was nearly $11 billion and is expected to increase to $12.5 billion by 2030. The city of Chicago had a required contribution of $2.4 billion in FY 2024.

It’s a heavy lift to increase the health of the pension systems across Illinois, as employer pension contributions now make up a significant portion of budgets. There is a challenge in ensuring that state and local governments have the revenue to pay the contributions needed to improve the funding level of pension systems while making adequate investments in public services.

Any new costs associated with benefit improvements on top of the budgetary strain from pension legacy debt will be used by opponents to argue against any fixes to the unfair Tier 2 system in Illinois. However, modernizing the state’s tax structure could allow Tier 2 improvements without jeopardizing the financial stability of the pension funds or government budgets.